Are you wondering which one is the cheapest renters insurance provider in Toronto (Ontario)? I tried to check it out myself to see how much the quotes varied between different insurance providers for a 1 bedroom apartment located in downtown Toronto.

For my 1 bedroom unit – I got an online quote from TD Insurance, Square One Insurance, RBC Insurance, Co-Operators Insurance, PC Insurance, Allstate, Intact Insurance and Aviva.

Here are all the estimates I got

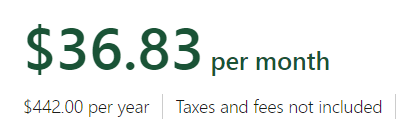

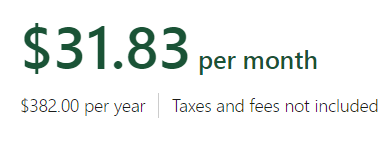

TD Insurance

TD gave me a quote of $36.83 per month!

Deductible for this quote was $1,500 and personal liability of $1,000,000.

When the deductible was set to $5,000 – TD gave me a quote of $31.83 per month

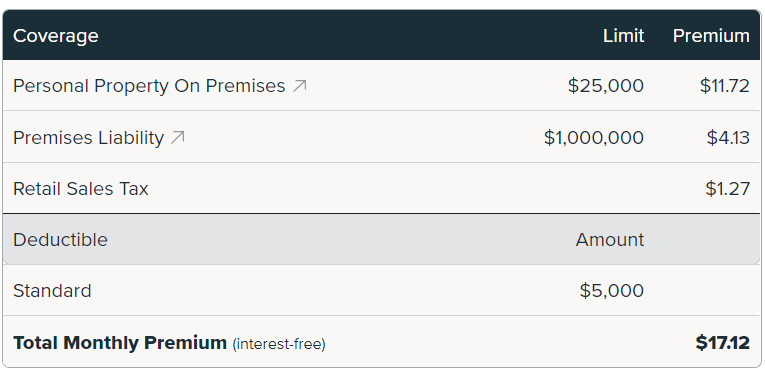

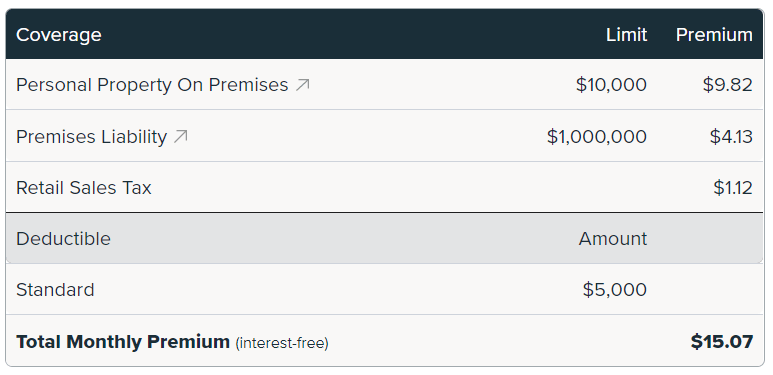

Square One Insurance

I got a quote of $17.12 per month from Square One Insurance.

Deductible for this quote was $5,000 and premises liability was $1,000,000.

That was the lowest quote offered by Square One Insurance.

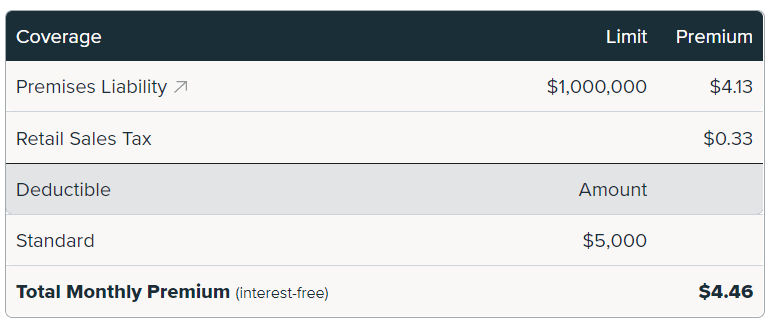

If I waived Personal Property on Premises Coverage with Square One then my quote was only $4.46 per month! This is not recommended as in case of theft, you won’t have any coverage!

When I set the personal property to $10,000, Square One gave me a quote of only $15.07 per month! This is almost half of what TD insurance offers when the deductible with them was $5,000 and personal property of $10,000 covered.

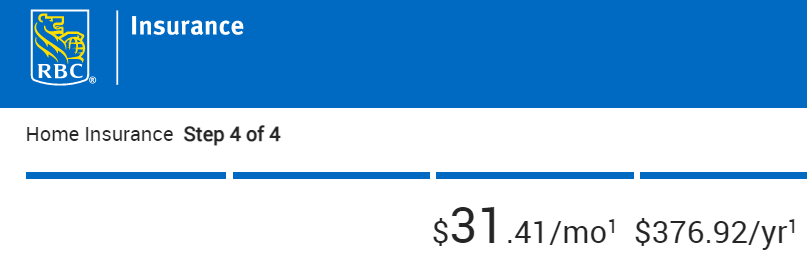

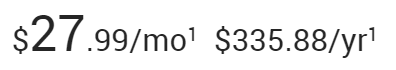

RBC Home Insurance

RBC gave me a quote of $31.41 per month!

Deductible for this quote was set to $1,500.

I could not reduce the personal property coverage which was set at $35,000.

When the deductible was set to $5,000 – the monthly rate reduced to $27.99

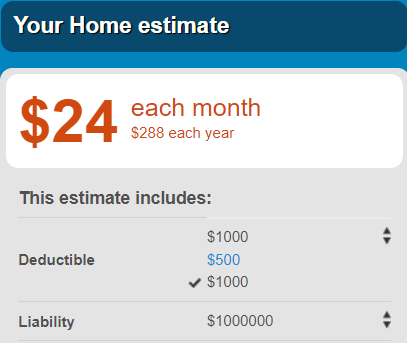

Co-Operators Property Insurance

Co-Operators gave me a quote of $24 per month!

Also the maximum deductible you could select for the renters insurance is $1,000.

Personal Property coverage was set to $30,000 which is the lowest I could set to.

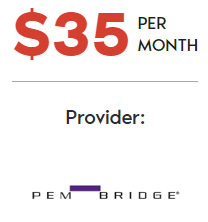

PC Insurance

PC Insurance quote was at $35 per month.

Maximum deductible allowed was $1,000 with the provider.

Personal Property was at $50,000 which is the lowest they offer.

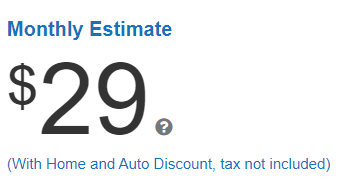

Allstate Tenant and Renters Insurance

The quote I got from AllState was for $29 per month.

Policy deductible was $1,000 and premises liability was $2,000,000!

Personal Property was covered at $30,000

I couldn’t change any of the amounts while getting the quotes online!

Intact Insurance

Renters insurance quote from Intact was $45 per month.

Deductible couldn’t be changed and was set to $1,000.

Personal Property was set to $30,000.

Premises Liability for the quote was $1,000,000.

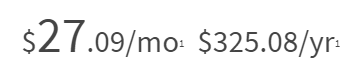

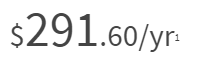

Aviva Insurance

For a deductible of $1,000 I got a quote of $27.09 per month with Aviva!

Personal liability limit was at $1,000,000.

Personal property was covered upto $35,000.

When I increased the deductible to $5,000, I got a quote of $24.3 per month!

Which one is the cheapest renters insurance provider in Toronto?

Tenants insurance can vary quite a bit depending on what part of Toronto you are going to be living in, who would be residing in the property, prior claims history as well as the type of the property.

The cheapest might not turn out to be the best.

If you are just looking at the lowest price per month that is possible then Square One Insurance offered the lowest price however the deductible was quite high at $5,000 and no personal property coverage.

If you want a lower deductible then Co-Operators Home Insurance appear to be a better option as the deductible was only $1,000 and personal property was well covered as well.

Get your own quote for renters insurance!

You might get a completely different quote than what I got because the renters insurance is calculated on a number of things! Also while providing quotes, there are a number of additional questions that the insurance provider might ask like what kind of security you have and that can alter your prices a lot.

Tom Mehra, an Ottawa-based Software Engineer with a Masters in Information Systems from the University of Texas at Dallas, shares insights on local food spots and top attractions in Canada and the US. He’s also a former resident of the US, UK, and India, and in 2023, his blog was nominated for an Ottawa Award by Faces Magazine. He is also a cat sitter.