Living in Toronto can be quite expensive! In this post, I have outlined the expenses associates with residing in the city and also offered suggestions on how you can minimize your living costs.

Toronto is an expensive city to live in! Here I have provided a breakdown of what it will cost you to live in the city! I have also provided some guidance on how you can reduce your living expenses.

Cost of housing in Toronto

A major portion of your monthly expenses will be going towards housing. In downtown Toronto, a single bedroom apartment can cost you between $2000-3000 per month while a 3 bedroom unit would be somewhere between $3000-4000 per month depending on if it’s downtown or in the suburbs.

Guidance on housing

If you are making more than 3-4x times the monthly rent of the unit then you are doing well enough in terms of income! However, not everyone is fortunate enough to be in that salary range!

If you are making less than that, it would be ideal to look for a room within a house or in the suburbs, though that would mean that you will have to commute which can be unbearably long in the Greater Toronto Area.

Low-income people might be eligible for affordable housing program that is offered by the City of Toronto. However, It can take years before you are allotted a rental unit through the program.

Unfurnished units are usually cheaper than furnished units. It is advised to go for unfurnished units if you plan to stay at the same place for long term however if you are only planning to live for a short term in the city then going for a furnished unit might make more sense.

Cost of groceries in Toronto

Groceries can vary as well depending on how much you are going to be eating at home versus outside. Also, the prices of groceries will depend on where you are getting them from.

If you were grocery shopping from one of the stores in Chinatown, your grocery expenses might just end up being $250-300 per month! I have assumed that you would primarily be buying veggies and chicken! However, if your diet primarily consists of meat/seafood then you can add another $150-250 per month in your expenses!

If you are going to be eating outside, a meal at a regular restaurant is going to cost you about 15 bucks! If it’s a finer restaurant then it might go around 40-50 bucks! Drinks usually cost around 10-15 bucks. Also note that this doesn’t include taxes and tips.

Guidance on Groceries

Avoid getting groceries from convenience stores. Usually the price is marked up to 2-3x times the regular price. Reserve your visits to the convenience store when you really need something urgently and are short on time.

Find stores near you and their pricing. Stores that sell organic or specialty foods are going to be more expensive. If it’s possible for you to commute then look for large stores that offer groceries at competitive prices, for example – Walmart, Hmart etc.

Utility Bills (Electricity and Water)

Depending on your accommodation, sometimes you do not have to pay for water and is included within your rental payments. However, almost always you will have to pay for electricity!

For a single bedroom unit your utility bills can vary between $150-250 per month! Bills are going to be higher during winters as you will be utilizing heaters and lower in summers, so budget accordingly.

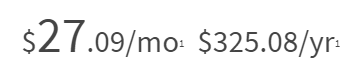

Phone Bills can vary all the way from 15 bucks to more than 50 bucks. The cheapest plans will usually come with limits around voice minutes, texts and data.

Guidance on Utility Bills

You can always ask the landlord how much is the current utility bill for the unit before you end up renting it. Usually older units tend to have higher bills as they are more inefficient. However, you can try to control your costs a bit by insulating windows or by turning off air-conditioning/heating when you are not using. (You might need to have a minimum temperature set though as a requirement by your landlord)

While a lot of people end up getting a phone on contract, it’s not a requirement and you can always bring your own phone. If looking for international data roaming, I found 3hk to be the cheapest data plan available.

Public Transit Costs

The city of Toronto has a public transport system and is accessible throughout the city. It is going to cost you around 3 bucks for a one way ticket which is valid for about 2 hours from the moment you hop onto the bus/streetcar. Note that this ticket will let you ride within the city limits. If you are planning to travel to any of the suburbs within the Greater Toronto Area, you will have to pay extra.

Guidance on Public Transit

If you are using public transit on a daily basis, it is advisable to have a monthly pass that is going to save you a bit of money. You can even share the pass within your family members, but only one individual can use it at a time.

Cost of Car and Car Insurance

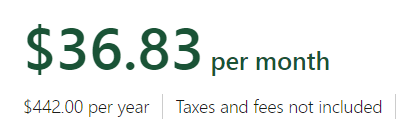

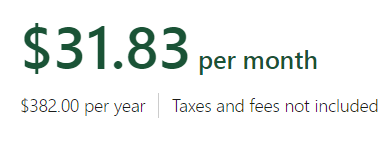

If you are living and working in downtown Toronto, you wouldn’t really need a car! But in case your work requires you to drive on a regular basis then a new car could cost you between $20K-40K! Plus you will have to pay taxes and registration fees on it as well which depends on the car/model that you end up getting.

Something important to note here is that usually you do not get FREE parking when you rent out a unit in Toronto, you will have to pay for it! The closer to the downtown you live, the higher the prices for parking are! Monthly parking costs can be between $150-450 per month.

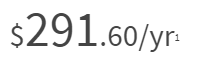

Insurance can vary depending on if you have prior driving experience or not. While people have reported insurance costing them more than $600 per month! For people with experience it might be around $200-250 per month.

Guidance on Car

Instead of getting a brand-new vehicle you could get a pre-owned vehicle which will cost you a lot less. I would recommend that you go for a car no more than 5 years old! It would cost you between $5K-15K for a used car depending on the model and its current condition.

If you need cashflow, don’t pay for the car in full, instead go for a car loan and pay for the car in monthly installments.

Guidance on Car Insurance

For car insurance, I recommend that you get quotes from multiple car insurance providers directly and see if they can give you a nice deal. If you have international driving experience, do let them know as that can definitely help you.

In case you have an international driving license, you should get the Canadian Driving License as usually the insurance rates are lower when you have one.

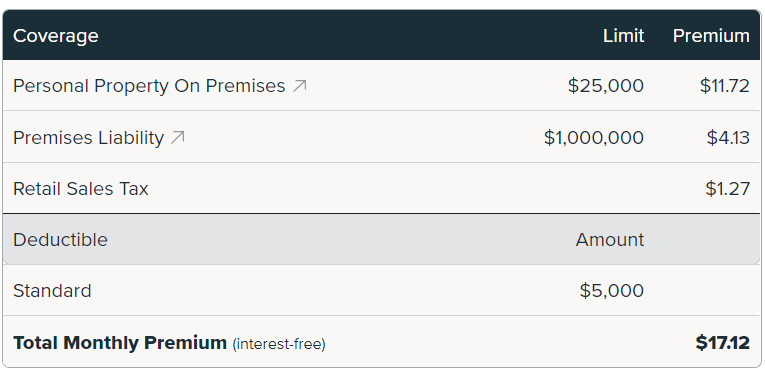

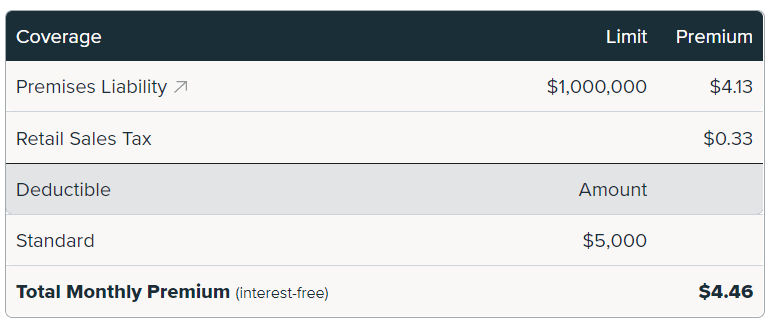

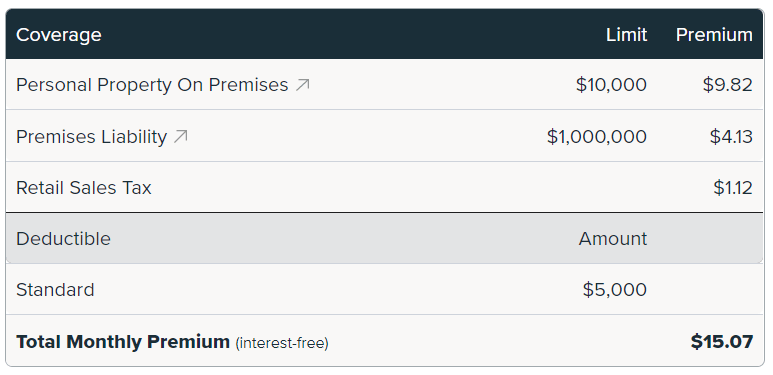

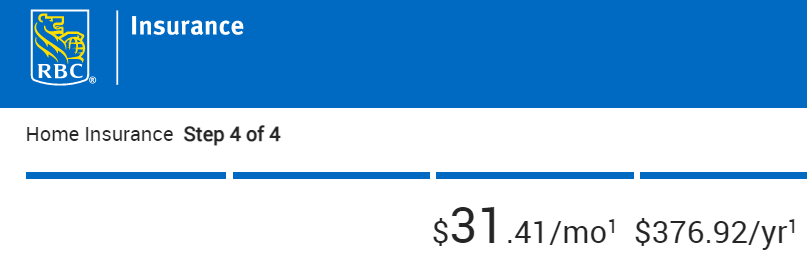

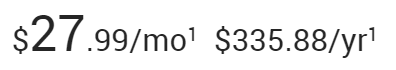

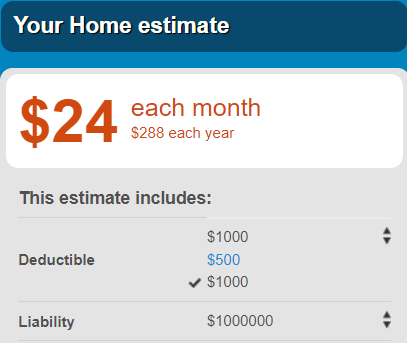

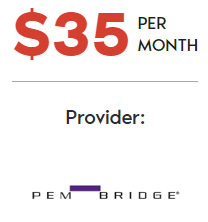

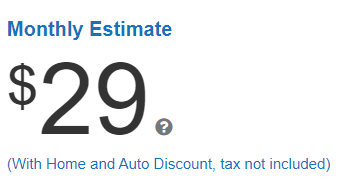

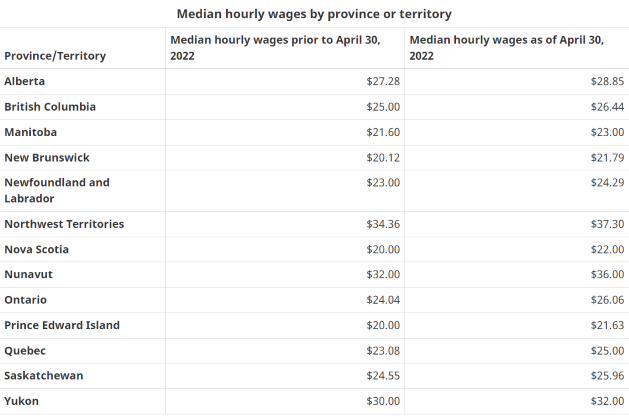

Cost of Renter Insurance

Usually renters insurance is going to cost you about $20-30 per month. Rates can be higher if your risk is higher. For example – if you are living in a flood prone area, older units, the risk tends to be higher and so are the insurance rates.

When going with cheap renters insurance, make sure to check what is included in the coverage as the deductibles on those can be very high.

Cost of Healthcare

Ontario has a public healthcare system which means as a resident of Ontario, you do not have to pay any additional expenses for a visit to the hospital. If you go to a clinic, the visit would be free however you would need to pay for prescriptions. To be eligible you would need to have an OHIP card.

Note that Dental is not covered within the Healthcare system in Ontario which means you have to pay for expenses out-of-pocket. Fillings could cost $150-300 depending on the dentist plus x-rays if needed. You will need to contact the dentist to get the exact pricing for dental work.

Guidance on Private Insurance

If your employer/school offers a private healthcare plan, do opt into it especially if it covers dental/vision. If your spouse is working, then you might have the option to be covered through your spouse’s plan.

Entertainment Costs

If you are going to a nightclub it’s going to be $5-15 for entry and about $10-15 per drink. A visit to the Cinema is going to cost you about $15.

Guidance on Entertainment

There are lots of clubs that let you have free entry if you show up early! Some places will let you in for free if you make a party reservation (contact them in advance!) Just go on the location’s Facebook page/website or contact them to know if they have free entry for coming early! You can even find deals on movie tickets as well!

How Much In Total Would It Cost In Toronto?

If I were to add everything up, for a single individual it would cost about $4000-4500 per month. You can add atleast another $500-1000 per month if you have a partner. If you have a child then childcare expenses would be about $1500-2000 per month.

Tom Mehra, an Ottawa-based Software Engineer with a Masters in Information Systems from the University of Texas at Dallas, shares insights on local food spots and top attractions in Canada and the US. He’s also a former resident of the US, UK, and India, and in 2023, his blog was nominated for an Ottawa Award by Faces Magazine. He is also a cat sitter.